What is The Advance Premium Tax Credit, and Why do I need this form?

The Advanced Premium Tax Credit is part of the "Affordable Care Act," where the government subsidizes a portion of your insurance premiums. To get this tax credit, you need to apply for the insurance through the government-established "marketplaces" aka exchange. The marketplaces are administered by either your state or the federal government, depending on each state. In New York, you can apply here.

Form 1095-A

The 1095-A form provides information about your insurance policy, your premiums, any government subsidies, and the people in your household covered by the policy. This information is needed for you to complete your income tax filing, adjust any tax credit payments and claim any premium tax credits that may be due or are required to be paid back if too much advance premium tax credit was received during the year.

Where can I get a copy of the 1095-A?

- If you bought health insurance through marketplaces, you should receive a Form 1095-A in the mail at the end of every year.

- If you misplaced the form, no worries. The form can be found online, by logging into your marketplace exchange account.

|

Here is how to get a copy of your 1095-A from the New York Exchange

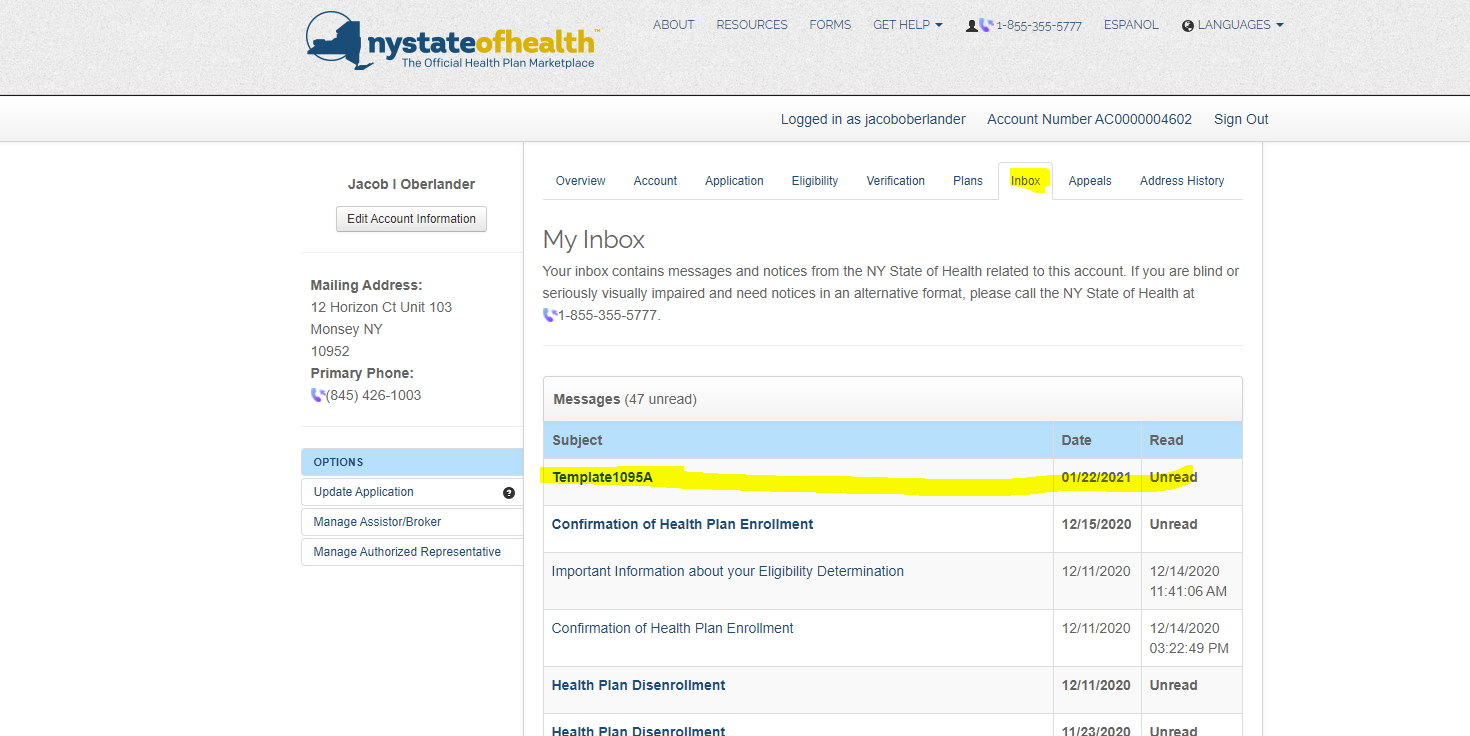

- Click on "Inbox"

- Check your recent messages. See the screenshot below.

|

Now that you have gotten the form, you are ready to use the credit on your tax return.

Two ways to take the tax credit

Taxpayers who are eligible for the Premium Tax Credit have a choice in how they receive it. You generally make the choice at the time you buy coverage in the Marketplace. The options are:

- Use the credit to reduce your taxes when you file your return at tax time.

- Use the credit to reduce your insurance premiums in advance when you pay the insurance premiums.

The first option is pretty straightforward: At tax-filing time, you figure out the amount of your credit and then subtract that amount from your tax liability.

The second option is more complicated because the government gives you the credit in advance—by sending money to your insurer to reduce your premiums. In this case, you figure out the amount of your credit and compare it to the amount paid to your insurer to reduce your premiums.

Using the information on the form

Whichever option you choose for taking the Premium Tax Credit, you claim it by filing Form 8962 with your tax return. You'll need your Form 1095-A to fill out this form.

- If you used your credit to reduce your premiums, Form 8962 will tell you if you have any credit left over, in which case you could use it to reduce your taxes.

- On the other hand, if the amount paid to your insurer actually exceeded your credit, you would have to pay back the difference with your tax return.

This can happen if your income increases during the year and you didn't update your information with the Marketplace.