What Is Current Ratio and Why Does It Matter?

“Your Current Ratio is very good.” “Your Current Ratio should be better.” You probably heard that multiple times when reviewing your financials with your accountant, broker, or CFO. But what is the Current Ratio - is it better when it's higher or when it's lower? How do I calculate my Current Ratio? Can I improve my Current Ratio?

What is the Current Ratio, and why is it important to have a good Current Ratio?

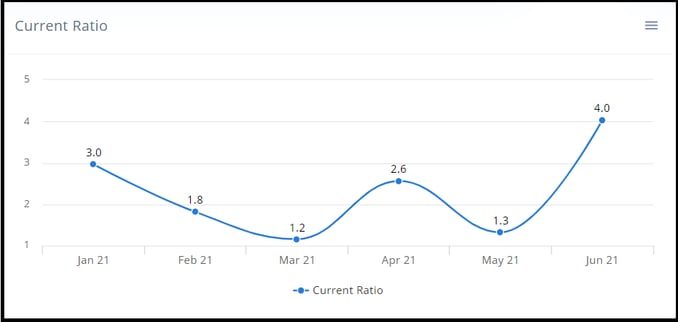

The Current Ratio, which is also called the working capital ratio, measures a company's ability to pay off its current debt (liabilities that are due less than one year) with its current assets. The Current Ratio is a number expressed between "0" and up. The term “current” usually reflects a period of about 12 months.

The current ratio is widely used by banks and financial institutions when sanctioning loans to companies, and therefore, it is vital for any company.

If your current ratio is high, it means you have enough cash. The higher the ratio is, the more capable you are of paying off your debts. If your current ratio is low, it means you will have a difficult time paying your immediate debts and liabilities.

Generally, a current ratio of 2 or higher is considered good, and anything lower than 2 is a cause for concern. However, good current ratios will be different from industry to industry.

How do I calculate my Current Ratio?

The Current Ratio is calculated by dividing current assets (Cash, Accounts Receivables, Inventory, etc.) by current liabilities (Accounts Payable, Credit Cards, etc.). The resulting number is the number of times the company could pay off its current obligations with its current assets.

Current Ratio = Current Assets / Current Liabilities

Let's take an example, a business that has $325,000 in current assets (Cash $75,000, Accounts Receivables $200,000, Inventory $50,000) and $215,00 in current liabilities (Accounts Payables $100,000, Credit Cards $100,000, Current portion on long term liabilities $15,000), the current ratio is $325,000 / $215,000, which is equal to 1.5. That means this hypothetical company can pay its current liabilities one and a half times its current assets.

Is a higher Current Ratio better?

Based on the previous example, it sounds like a higher Current Ratio is better, but the correct answer is that it depends on how it changes month over month. For example, always having a high Current Ratio can result from a few reasons:

- Their Accounts Receivables are very high, which may include old open invoices, and Accounts Payable are low, so they are using their cash to pay off expenses, but they are not good with collections.

-

They have a high value of old/unsellable inventory in stock, but the bills are paid off.

Even this company has a high Current Ratio that should present that they have enough cash to pay off all their current obligations; when looking into the details, they will not be able to pay it off with the current cash on hand.

How can I improve my Current Ratio?

✅ The correct answer is to increase your Net Income and make sure to get paid on time!

✅ Paying off your bills or short-term debt.

👉 While paying off accounts payable reduces both current assets (cash) and current liabilities by the same amount, it increases the current ratio.

The following two options won't help your current ratio;

❎ Collecting payment on customers' open invoices.

👉 When doing collections, you move your assets from one account (Receivables) to another (cash in the bank) with no effect on your assets as a whole.

You also need to make sure that all your accounts are correctly classified, and that all loans that are not due within one year move to long-term liabilities. If you had a long-term Loan receivable and it's now due in less than a year, you should move it to current assets.

Want to learn more? In this article, we explain the difference between profits and cash flow.

Check out our Virtual CFO page to learn more about the services that we offer.